CBN Governor, Olayemi Cardoso, Unveils Economic Outlook for 2025, Pushes for Greater Economic Diversification…details

CBN Governor, Olayemi Cardoso, has unveiled economic outlook for 2025, while encouraging for greater economic diversification.

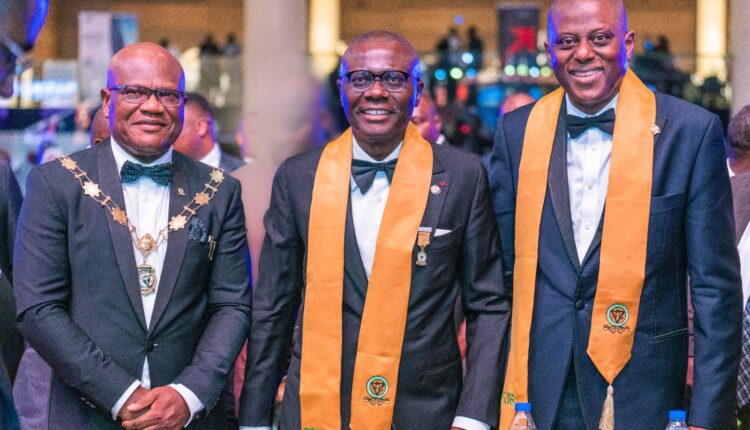

CBN Governor, Olayemi Cardoso, and Lagos State Governor, Babajide Sanwo-Olu bag CIBN Fellowship at 59th Annual Bankers Dinner of the Chartered Institute of Bankers of Nigeria (CIBN).

Mr. Cardoso reads riot act to financial institutions found engaging in malpractices or deliberate sabotage of seamless cash flow for Nigerians.

“The CBN will continue to maintain a robust cash buffer to meet the country’s needs, particularly during high-demand periods such as the festive season and year-end. Our focus is on ensuring a seamless cash flow for Nigerians while fostering trust and stability in the financial system” – Cardoso.

Cardoso however, urges customers to report difficulties withdrawing cash from bank branches or ATMs directly to the CBN with effect from December 1, 2024.

CBN to review the implementation of the e-Naira, to optimize broad and positive economic impact.

“Inflation remains unacceptably high, but the signs are encouraging. Our commitment is unwavering: we will prioritize price stability until its benefits are felt by every Nigerian” – Cardoso.

Cardoso highlights the resilience of Nigeria’s banking sector: NPLs under 5%, liquidity ratios over 30%. Banks are poised to fuel economic growth, with a focus on MSME credit access.

Cardoso celebrates Nigeria’s fintech triumphs as the ecosystem thrives, driving financial inclusion and attracting global investors. With several fintechs achieving unicorn status this year, Nigeria’s leadership in innovation is undeniable.

Cardoso unveils Payment System Vision 2025, designed to revolutionize cross-border payments, advance open banking, and expand the regulatory sandbox, driving innovation and economic growth in Nigeria.

Cardoso says CBN, in 2025, will prioritize initiatives including implementing open banking framework, advancing contactless payment systems, and expanding regulatory sandbox.

CBN launches comprehensive mentorship and capacity-building programmes aimed at equipping young minds with the skills and opportunities needed to drive innovation, economic resilience, and sustainable growth.

Cardoso charges banks to rise to their intermediation and market-making responsibilities, emphasising the need to deliver tailored solutions that empower customers to manage risks and operate their businesses effectively.

“This is not just the Central Bank’s journey—it is Nigeria’s journey. We are building an economy where every individual, every business, and every community can thrive. This vision will not be achieved by one institution alone. It requires all of us—banks, regulators, businesses, and citizens—to work together with steadfast resolve.” – Cardoso